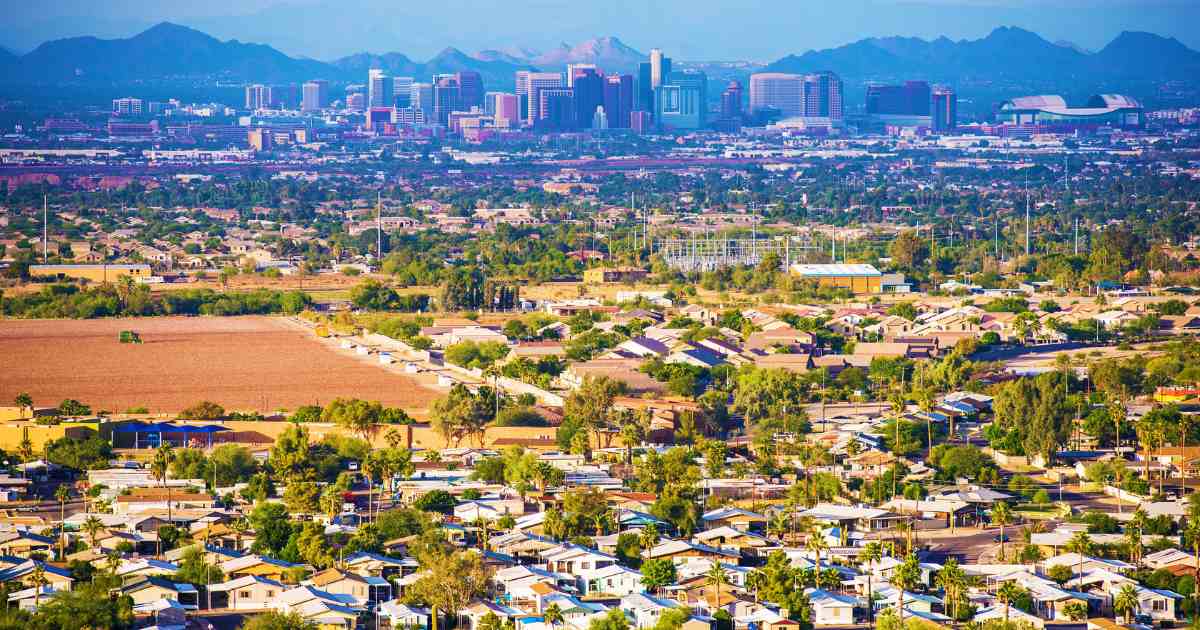

Same Day Car Title Loans In Phoenix

Whether you have bad credit or not, you can get quick hassle free financing in Phoenix with Desert Title Loans. All that matters is that you have sufficient equity in a vehicle worth $3,000 or more to qualify for a title loan. You won’t have to go to a financing office in Phoenix or be seen by a local loan officer. Instead, you can get everything done online or call us at 623-526-5001 to apply over the phone.

We specialize in offering online title loans with no inspection, allowing you to apply for and get pre-approved without a store visit in Arizona. That will enable you to get the cash you need and avoid the long lines with a local lender in Phoenix that will take days to process your application. We offer access to title loans of up to $20,000 for highly qualified vehicles, and customers can get their money through direct deposit in less than one business day! Besides all that, you can get approved with little to no credit history. Even if you recently defaulted on a bank loan or credit card, you should have no trouble getting approved for a title loan in Phoenix.

How does a Phoenix title loan work, and what to expect

Title loans use the equity from a paid off vehicle as collateral for a secured loan. Your lender will hold the car's pink slip for the duration of the loan, and most borrowers will repay their loan in 12 to 36 months. You can keep driving the vehicle while you make the required payments, and there's no need to give up the keys or have a tracking device installed on your car. Some lenders will ask for a second set of keys if you're looking to borrow $10,000 or more, but even with these high-dollar loans, you don't need to give up your vehicle as collateral.

The first step to getting a car title loan is to see how much your vehicle is worth. You can start online with Desert Title Loans, over the phone, or with a direct lender in Phoenix. However you choose to apply you can borrow 50% of the vehicle's assessed value, meaning a car worth $4,000 can lead to loan amounts of $2,000 or more!

It takes less than 30 minutes to apply for a title loan online with Desert Title Loans, and everything other than the vehicle inspection can be completed online! Title loans are great for applicants with a paid off vehicle, but what if you still owe money on the title or have a car worth $2,000 or less? The other way to borrow money with a vehicle in Phoenix is with a registration loan. In this case, you use your vehicle registration as collateral instead of the pink slip or car title. Registration loan amounts are often less than $1,000, but you won't have to put up your car's title as collateral and risk a repossession. Make your monthly payments on time, and you can renew your vehicle registration without problems!

What is required to be approved for car title loans in Phoenix, AZ

This type of loan requires that you own the vehicle you want to use as collateral, and the car should be valued at $4,000 or more if you want any chance of qualifying for a title loan of $2,000 or more. Other factors to consider are payment options, interest rates, co-signing responsibilities, restrictions, penalties, and repayment terms. As of 2024, you need to submit the following documents to get a title loan in Phoenix:

Vehicle Title: Any title loan company in Phoenix requires a paid off car or motorcycle as collateral. The title must be free of any liens and you have to be listed as the sole owner on the pink slip. Some lenders may accept cars that aren't completely paid off as they will pay off your existing loan. But in these cases, you can't owe much to the original lender, and your loan amount will be limited.

ID and Proof of Residency: A valid ID is required to verify your identity and age. You must be 18 years old to get a title loan in Arizona, and we also need to confirm that you reside within the state.

Income Verification: Other than a paid off vehicle, income verification is the most important requirement for any title loan in Phoenix. Acceptable forms of income verification include tax returns, government benefit statements, and employment records.

Vehicle Registration and Insurance: All cars and trucks used as collateral for a title loan must be deemed roadworthy within Arizona. That means you need proof of up-to-date registration from the MVD and evidence that your vehicle is fully insured.

You may notice one primary requirement missing from this list, which is often required for any other short-term loan. That's having good credit! With a Phoenix title loan, you don't need to lose sleep over a credit check when you apply with us. Most equity lenders in Arizona won't check your credit while underwriting your loan because a title loan is based on the value of your vehicle, not your credit score!

What else to know about online title loans in Phoenix, AZ

Do you know that Desert Title Loans also offers refinancing for title loans and registration loans with high interest rates? Even if the monthly payments fit in your budget, it makes sense to take a few minutes and see if we can lower the APR on your existing loan. Reducing the interest rate by even a few percentage points can save you thousands over one or two years of paying down the balance! We can also help if you're behind on your payments by finding a lender in Phoenix who is willing to buy out your title loan! Even if you're one month behind on your payments, there's still a chance you can avoid a situation where your lender sells the vehicle. Contact us anytime if you're struggling with a high interest rate or facing a vehicle repossession, and we'll let you know if a title loan refinance is possible.

Another factor when borrowers first look into a title loan in PHX is where to apply. Many people apply with Desert Title Loans online, submit all the vehicle information, and complete the document check in person with a local company. Other customers would instead work with a direct lender in Maricopa County that allows them to submit information in person. The bottom line is that it doesn't matter how you choose to apply, and we can help you get approved online, over the phone, or in person anywhere in Phoenix!

Apply online or call 623-526-5001, and we'll get you an instant quote for a title loan in Phoenix!

Other Cities In Arizona: